investment yield vs discount yield – Overview

Rate of return - Wikipedia, the free encyclopedia

This means that an investment of $100 that yields an arithmetic return of 50% . Comparison of arithmetic and logarithmic returns for initial investment of $100 . the discount rate of an investment, but it does affect the Annual Percentage Yield, .

http://en.wikipedia.org/wiki/Rate_of_return

Bond Equivalent Yield Formula

The yield on a T-bill is calculated using either the discount yield formula or the investment yield formula. The discount yield formula is useful for determining the .

http://www.buzzle.com/articles/bond-equivalent-yield-formula.html

Interest Rates and Yields on Mortgage Securities - Investing In Bonds

Mortgage securities are often priced at a higher yield than Treasury and . yield. For securities purchased at a discount to face value, faster prepayment rates will .

http://www.investinginbonds.com/learnmore.asp?catid=11&subcatid=56&id=135

.png)

Ecuador Tours by Latin Excursions

Estimating Yields on Treasury Securities - Fedpoints - Federal ...

Both the discount yield and the investment yield, as well as the high, low and average prices of the auctioned T-bills, are made public in an official Treasury .

http://www.newyorkfed.org/aboutthefed/fedpoint/fed28.html

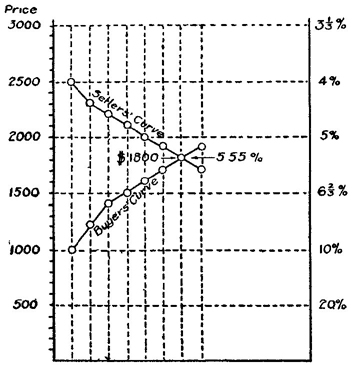

Capitalization Rates and Yield Rates in Real Estate

These future cash flows are discounted back to present value using a discount rate appropriate for the investment. This discount rate is a yield rate and not a cap .

http://propex.com/C_g_capvs.yld.htm

Yield, Duration and Ratings of Bonds

If you purchase the bond at a discount, yield to maturity will reflect the fact that at maturity you . Anything with BAA or higher is called an "investment grade bond.

http://www.investorguide.com/igu-article-572-bonds-yield-duration-and-ratings-of-bonds.html

Discount Yield Definition | Investopedia

Discount yield is a measure of a bond's percentage return. . This yield calculation uses a 30-day month and 360-day year to simplify calculations. . yield figure is a slightly inaccurate measure of an investor's true return on investment.

http://www.investopedia.com/terms/d/discount-yield.asp

Discount Yield

Fixed income markets have standard formulas for quoting the yield on various . The bank discount yield (or simply discount yield) of a discount instrument . yield Any of several metrics of the income or return to be earned from an investment.

http://www.riskglossary.com/articles/discount_yield.htm

Fidelity Learning Center: The Yield to Maturity and Bond Equivalent ...

Finally, the discount yield is the bond's return expressed as a proportion of its face value. For example, a one-year zero-coupon bond costing $900 and paying a .

https://www.fidelity.com/learning-center/fixed-income-bonds/yield-maturity-bond

Discounting - Wikipedia, the free encyclopedia

Since a person can earn a return on money invested over some period of time, most economic and financial models assume the "Discount Yield" is the same as .

http://en.wikipedia.org/wiki/Discounting

Mercer Yield Curve and Index Rates in the US

Sep 5, 2012 . pension discount discount rate discount rates yield curve pension . to plan sponsors as they evaluate their benefit, funding and investment .

http://www.mercer.com/articles/1213490

What is the difference between rate and yield

The yield is calculated by dividing the interest amount received by the price paid for the investment, and the time held. So, if you bought a bond at a discounted .

http://wiki.answers.com/Q/What_is_the_difference_between_rate_and_yield

discount yield - Invest Definition

discount yield investment & finance definition. The return on a security that is sold at a discount, such as money market instruments, commercial paper, and .

http://invest.yourdictionary.com/discount-yield

How To Compare Yields On Different Bonds

Oct 23, 2010. how to equalize and compare fixed-income investments with different yield . The amount of the discount is stated as a percentage of the face .

http://www.investopedia.com/articles/bonds/08/bond-yield-convention-conversion.asp

Yield Basis Definition | Investopedia

Unlike stocks, which are quoted in dollars, most bond quotes include a yield %. . at a discount because its yield basis (9%) is greater than its coupon rate (6.75%). . Investing in bonds - What are they, and do they belong in your portfolio?

http://www.investopedia.com/terms/y/yield_basis.asp